The Sydney Opera resumed live performances and the city of Melbourne recently hosted the Australian Open tennis tournament with fans (mostly) in attendance.

Japan is back to planning the delayed 2020 Summer Olympics, while China focuses on the Beijing 2022 Winter Games. Having been hit by COVID-19 first, Asia is also recovering first. At the pandemic’s first anniversary, is the region back to full health?

Asia must remain agile and innovative to exit the crisis in a durable, greener, and more equitable way

The best answer is that it is too early to know for sure. The pandemic exacerbated existing long-term issues: slowing productivity growth, growing indebtedness, aging population, rising inequality, and managing climate change. A new IMF staff paper looks into how the region can navigate these multiple challenges.

Long-lasting effects

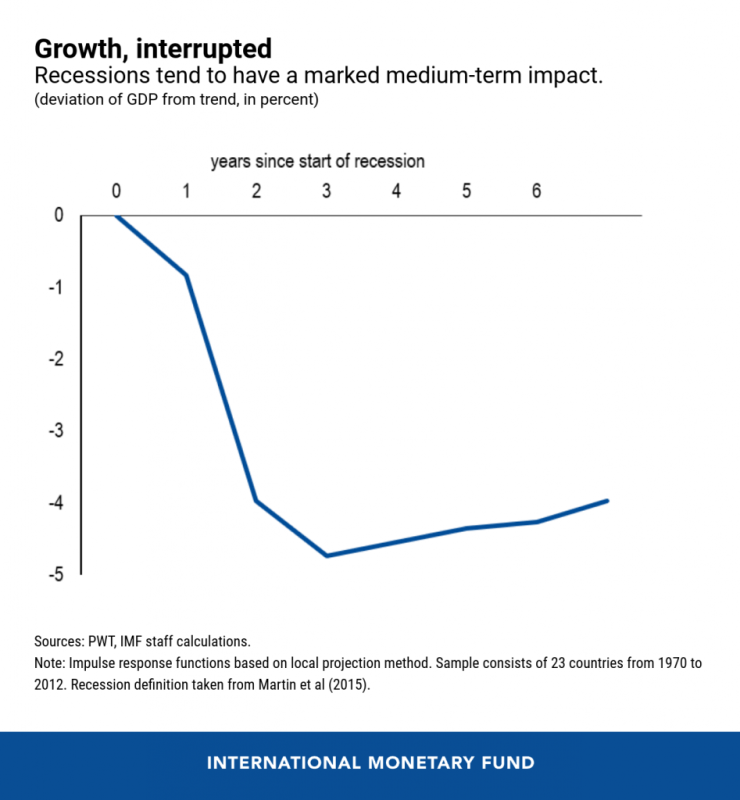

If past experience is any guide, this pandemic will have long-lasting effects. A look at past recessions in advanced economies reveals that on average, five years after the start of a recession, output is still almost 5 percent below its precrisis trend and unlikely to ever catch up.

The COVID-19 pandemic has been a perfect storm, destroying jobs, worsening poverty and inequality, and creating a public and private debt problem—especially for countries and firms already in fragile financial health beforehand.

This unprecedented economic disruption has the potential to leave lasting scars for years to come, arising from persistent declines in the capital stock, employment, and productivity.

Asia’s labor markets suffered, with unemployment surging, labor force participation plunging, and job losses concentrated in industries with lower wages and among women and youth. The poorest and most vulnerable were disproportionately hit, exposing severe gaps in social protection and exacerbating already high inequality in advanced and emerging Asia.

Public and private debt hangover

In the pandemic’s aftermath, many countries will have to contend with high public and private debt burdens—possibly too large for some to manage. Sovereign debt is an issue in small states. Tackling this issue will require extra focus on revenue mobilization, public finances, and debt management, with support from multilateral partners and debt relief providing some breathing space.

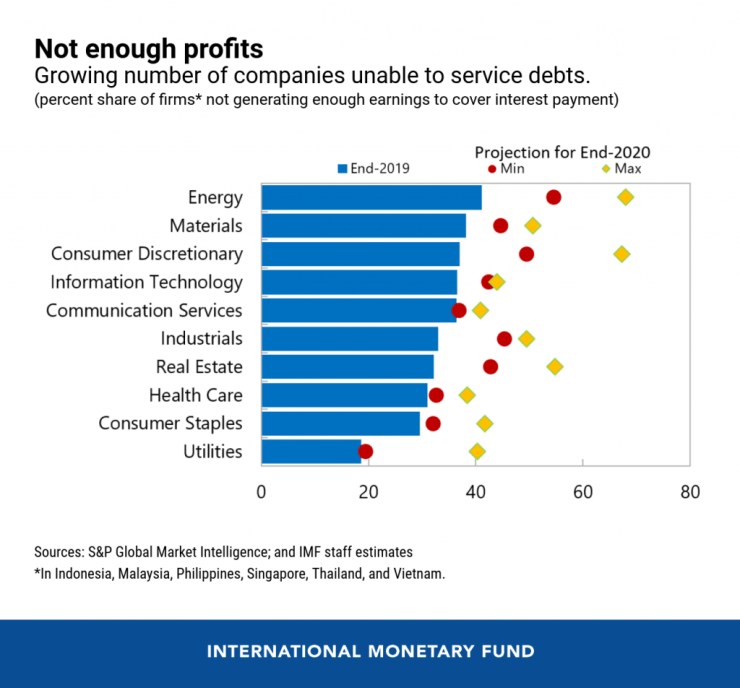

In larger emerging markets, the main problem might be record-high private debt. More and more companies are not generating enough earnings to service their debts. Government support is helping them to keep afloat,…

Discover more from Siam News Network

Subscribe to get the latest posts to your email.